Fund Information

Shriram Multi Sector Rotation Fund

By clicking on Invest Now or Start an SIP, you agree to the Terms and Conditions of Shriram AMC and authorize our representatives to contact you via phone, email, SMS, WhatsApp regarding your application. This will override any NDNC registration you have made.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Nisi ratione tempore, illo molestiae neque accusamus corporis suscipit commodi aliquam ipsum porro.

Sector rotation is an investment strategy that involves shifting investments between different sectors of the economy based on their performance during various occasion or the business cycle. The goal is to maximize returns by investing in sectors that are expected to perform well at specific times, and moving out of sectors that may underperform.

Focused 3 to 6 sectors in one fund

Rotation across trending sectors

No capital gains tax when fund manager rebalances

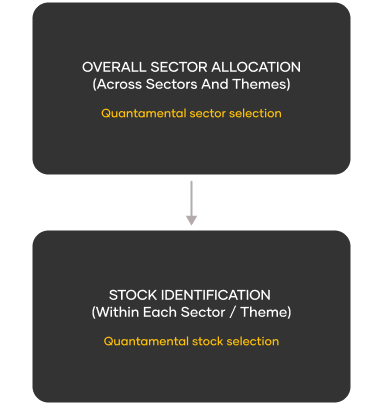

2 Tier approach for managing Shriram Multi Sector Rotation Fund

Trending sectors are selected using a Quantamental approach

Disclaimer: Investment philosophy stated above may change from time to time without any notice and shall be in accordance with the strategy as mentioned in the Scheme Information Document

Fund Information

Shriram Multi Sector Rotation Fund

Benchmark

Nifty 500 Total Return Index

Fund category

Equity – Sectoral / Thematic

Fund type

An open-ended scheme investing in equity and related instruments following multi sector rotation theme

Scheme objective

The investment objective of the scheme is to generate long-term capital appreciation by employing a quantamental approach of investing in equity and equity derivatives of specific sectors that are trending due to better earnings expectation. The allocation among sectors and stock selection will be decided by the in-house proprietary quantitative model and further augmented with fundamental analysis. There is no assurance or guarantee that the investment objective of the Scheme will be achieved.

Scheme Plans & Options

Regular Plan

Direct Plan

Fund manager

Mr. Deepak Ramaraju, Ms. Gargi Bhattacharyya Banerjee

Minimum investment

For Purchase - Re. 500/- and in multiples of Re 1/- thereafter.

For Switch-in - Re. 500/- and in multiples of Re 1/- thereafter.

Minimum Additional Purchase Amount Minimum of Re. 500/- and in multiples of Re. 1/- thereafter

Exit load

1% of the applicable NAV, if redeemed within 3 months from the date of allotment.

Benchmark riskometer is at very high risk.

As per AMFI Tier 1 Benchmark i.e Nifty 500 TRI*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Performance of Shriram Multi Sector Rotation Fund - Regular Growth as of Apr 23, 2025

Returns of Direct Plan - Growth Option as on 23-Apr-2025 Date of inception 09-Dec-2024 | ||||||||

|---|---|---|---|---|---|---|---|---|

| NAV Rs. 8.11 | AUM Rs.(in crore)NA | |||||||

| Date | Period | Nav (Rs.) Per Unit | Scheme Returns (%) | Scheme Benchmark Returns (%) | Additional Benchmark (NIFTY50) Returns (%) | Current value of ₹ 10,000 invested | ||

| Scheme | Scheme Benchmark | Additional Benchmark (NIFTY50) Returns (%) | ||||||

| Dec 09, 2024 | Since Inception(09 Dec 2024) | 10.0000 | -18.88% | -4.33% | -0.94% | ₹8,112 | ₹ 9,567 | ₹ 9,906 |

Returns of Regular Plan - Growth Option as on 23-Apr-2025 Date of inception 09-Dec-2024 | ||||||||

|---|---|---|---|---|---|---|---|---|

| NAV Rs. 8.06 | AUM Rs.(in crore) | |||||||

| Date | Period | Nav (Rs.) Per Unit | Scheme Returns (%) | Scheme Benchmark Returns (%) | Additional Benchmark (NIFTY50) Returns (%) | Current value of ₹ 10,000 invested | ||

| Scheme | Scheme Benchmark | Additional Benchmark (NIFTY50) | ||||||

| Dec 09, 2024 | Since Inception | 10.0000 | -19.41% | -4.33% | -0.94% | ₹8,059 | ₹9,567 | ₹ 9,906 |

(as on 31 Mar 2025)

Equity

94.51%Net Receivables / (Payables)

5.49%(as on 31 Mar 2025)

Banks

18.51%Telecom - Services

5.02%Consumer Durables

11.93%Healthcare Services

14.30%Diversified FMCG

3.61%| Name | Sector | Instrument | Assets |

|---|---|---|---|

| ICICI BANK LTD | Banks | Equity | |

| HDFC BANK LTD | Banks | Equity | |

| Net Receivables / (Payables) | Others | Net Receivables / (Payables) | |

| BHARTI AIRTEL LTD | Telecom - Services | Equity | |

| BLUE STAR LTD | Consumer Durables | Equity |

(as on 31 Mar 2025)

Banks

18.51%Telecom - Services

5.02%Consumer Durables

11.93%Healthcare Services

14.30%Diversified FMCG

3.61%Cement & Cement Products

12.44%Finance

12.34%Food Products

3.34%Pharmaceuticals & Biotechnology

6.79%Beverages

2.13%Diversified

2.07%Household Products

2.03%Others

5.49%

Mr. Deepak Ramaraju is a highly experienced Senior Fund Manager at Shriram Asset Management Company Ltd, with over two decades of diversified experience under his belt. He holds a degree in chemical engineering and has been associated with equity markets for the past 16 years. Before joining Shriram Asset Management Company, Mr. Deepak was part of the global equity research team and advised the Sanlam Group of South Africa on their India-focused fund. Prior to his stint in the financial industry, Mr. Deepak worked as a researcher and co-inventor at GE India Technology Center, Bangalore. During his time there, he was credited with 10 patents, highlighting his expertise and innovative abilities. His diverse background and extensive experience make him a valuable asset to the Shriram Asset Management team.

Ms. Gargi Bhattacharyya Banerjee serves as the Fund Manager of Shriram Mutual Fund having an experience of more than 20 years in her professional career. She received her Bachelor of Science with Economics (H) and Master of Business Management with specialization in Finance from the University of Calcutta. She joined as Research Manager in Shriram Asset Management Company Limited in November 2012 and before that, she has held key position in the Research team with Zacks Research Private Limited and Shriram Insight Share Brokers Limited.

Mr. Sudip Suresh More has around 19 years of experience in managing Fixed Income Investments, Macroeconomic Research and Credit Analysis. Prior to this assignment, Mr. Sudip Suresh More was Debt Fund Manager at Kshema General Insurance Company. Additionally, he has also worked with Sahara India Life Insurance Company Ltd as a Debt Fund Manager whereby managing ULIP and Traditional funds on Fixed Income side.

It is an open-ended scheme investing in equity and related instruments following the multi-sector rotation theme. Shriram Multi Sector Rotation Fund aims to provide diversification by focusing on 3 to 6 trending sectors within one fund, potentially reducing concentrated risks. The fund seeks to avoid sector traps by rotating across sectors that are expected to show better earnings, which may help minimize risks. It is designed to be tax-efficient, as no capital gains tax is incurred when the fund manager rebalances the portfolio, making it a potentially smart and efficient investment choice.

The investment objective of the scheme is to generate long-term capital appreciation by employing a quantamental approach of investing in equity and equity derivatives of specific sectors that are trending due to better earnings expectations. The allocation among sectors and stock selection will be decided by the in-house proprietary quantitative model and further augmented with fundamental analysis. There is no assurance or guarantee that the investment objective of the Scheme will be achieved.

This product is suitable for *investors who are seeking

Capital appreciation over the medium to long term in an actively managed portfolio of equity & equity-related instruments of specific identifiable sectors that are performing well

Sustainable alpha over the benchmark

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The asset allocation for the Shriram Multi-Sector Rotation Fund is as follows:

Equity and Equity-related Instruments following the multi-sector rotation theme: Minimum 80%, Maximum 100% of total assets

Other Equity and Equity-related Instruments: Minimum 0%, Maximum 20% of total assets

Money Market Instruments and Cash: Minimum 0%, Maximum 20% of total assets

The Fund follows a blend of value and growth style of investing. The fund will follow a bottom-up approach to stock-picking and choose companies across sectors and market capitalizations. Each stock in the portfolio will have an investment rationale and capital allocation to each stock will be made based on top-down sector view, stock valuations, macro-economic factors, and trends. Each stock will be monitored and reviewed regularly to confirm the investment rationale.

Mr. Deepak Ramaraju currently manages the scheme along with Ms. Gargi Bhattacharyya Banerjee.